Does Afterpay Affect Credit Score? The Truth Behind Buy Currently, Pay Later On Solutions

Exploring the Relationship In Between Afterpay and Your Credit Scores Rating

In the era of digital settlements and flexible costs choices, Afterpay has actually become a popular selection for customers looking for to manage their purchases conveniently. Nevertheless, among the benefit it offers, questions stick around regarding just how using Afterpay may influence one's credit scores ranking. As people browse the realm of personal money, understanding the intricate relationship between Afterpay use and credit history comes to be extremely important. It is important to explore the nuances of this link to make educated choices and safeguard monetary wellness.

Afterpay: A Review

Afterpay, a prominent gamer in the buy-now-pay-later market, has swiftly gotten popularity amongst customers seeking versatile settlement services. Founded in Australia in 2014, Afterpay has actually increased globally, supplying its solutions to countless clients in numerous nations, including the United States, the UK, and Canada (does afterpay affect credit score). The system permits consumers to make acquisitions instantly and spend for them later on in 4 equivalent installments, without incurring passion charges if payments are made on time

One trick function that establishes Afterpay apart is its smooth combination with online and in-store retailers, making it convenient for users to access the solution throughout a wide variety of shopping experiences. Furthermore, Afterpay's simple application procedure and immediate authorization choices have added to its charm among tech-savvy, budget-conscious customers.

Recognizing Credit History Scores

As consumers engage with numerous monetary solutions like Afterpay, it becomes vital to understand the value of credit scores in evaluating individuals' credit reliability and economic stability. A credit score ranking is a mathematical depiction of a person's creditworthiness based on their credit report and current financial condition. Credit scores scores are used by loan providers, landlords, and also companies to assess a person's dependability in handling monetary responsibilities.

Debt scores normally vary from 300 to 850, with greater scores indicating a reduced credit scores risk. Aspects such as payment background, debt usage, size of credit score history, kinds of credit accounts, and brand-new debt questions influence an individual's debt rating. A great credit score ranking not just boosts the chance of car loan approvals yet also makes it possible for accessibility to far better rate of interest and terms.

Recognizing credit history ratings empowers individuals to make informed financial decisions, build a favorable credit scores background, and improve their total monetary well-being - does afterpay affect credit score. Consistently monitoring one's credit rating report and taking actions to keep a healthy debt rating can have lasting benefits in handling funds successfully

Elements Influencing Credit Report

Comprehending the vital elements that affect credit rating is vital for people seeking to keep or boost their financial standing. Payment history holds significant weight in figuring out credit report. Constantly making on-time settlements positively affects the score, while late or missed out on payments can you can check here have a harmful effect. The amount owed, additionally referred to as credit history application, is another vital factor. Keeping credit rating card equilibriums low in regard to the readily available credit line demonstrates accountable monetary habits. The size of credit report is one more component considered; a much longer history generally reflects even more experience handling credit score. New credit history inquiries can somewhat lower the rating, as it might show economic distress or a risky customer. Lastly, the mix of credit report kinds, such as credit rating cards, home mortgages, and installment lendings, can impact ball game favorably if taken care of well. Recognizing these factors and managing them properly can aid individuals keep a healthy and balanced credit rating and total financial well-being.

Afterpay Usage and Credit Scores Ranking

Taking into consideration the impact of numerous economic choices on credit report scores, the use of services like Afterpay can present distinct considerations in evaluating an individual's credit ranking. While Afterpay does not perform credit scores checks before authorizing users for their service, late payments or defaults can still have effects on one's debt record. When individuals miss repayments on their Afterpay acquisitions, it can cause unfavorable marks on their credit file, potentially reducing their credit rating rating. Because Afterpay's installation strategies are not always reported to credit bureaus, accountable use might not directly influence credit history positively. Nevertheless, regular missed payments can reflect inadequately on a person's creditworthiness. Moreover, regular usage of Afterpay may indicate economic instability or an inability to take care of costs within one's methods, which can additionally be factored right into credit history see page evaluations by loan providers. Consequently, while Afterpay itself might not straight impact credit report, how people manage their Afterpay accounts and connected payments can affect their overall credit scores score.

Tips for Taking Care Of Afterpay Sensibly

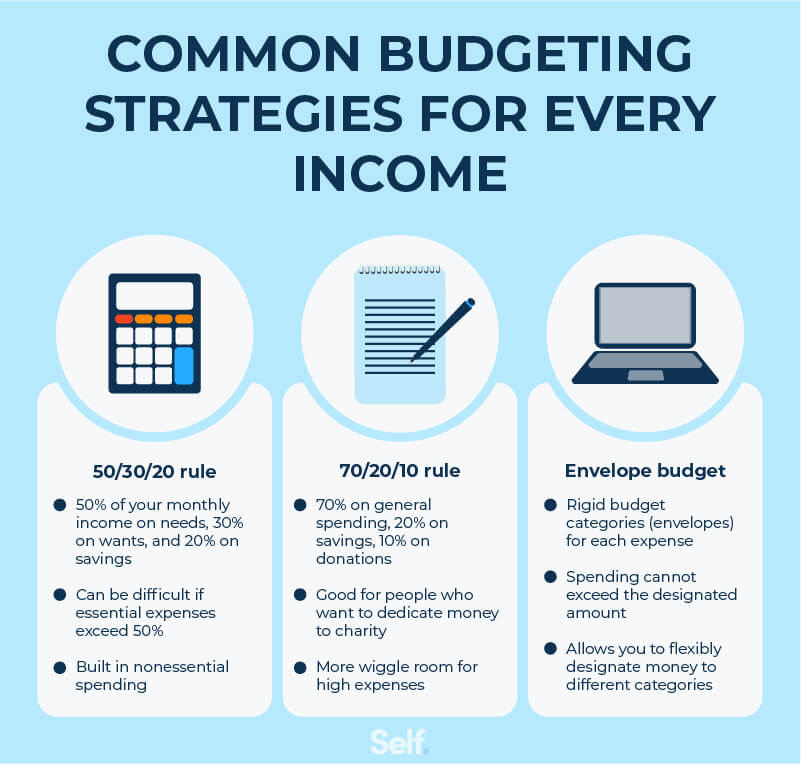

To efficiently handle Afterpay and maintain financial stability, it is essential to adhere to a disciplined payment schedule and budgeting technique. Establishing a budget plan that consists of Afterpay purchases and making certain that the payments fit within your total financial plan is crucial. It is essential to only make use of Afterpay for things you really need or allocated, rather than as a way to overspend. Checking your Afterpay transactions routinely can help you remain on top of your payments and stay clear of any shocks. In addition, monitoring your total amount exceptional Afterpay balances and due dates can avoid missed out on payments and late costs. If you locate yourself battling to pay, connecting to Afterpay or producing a settlement strategy can help you prevent destructive your credit ranking. By being positive and responsible in handling your Afterpay usage, you can enjoy the benefit it uses without compromising your monetary well-being.

Verdict

In verdict, the partnership between Afterpay and credit score ratings is facility. Handling Afterpay properly by making prompt payments and preventing overspending can aid alleviate any adverse effects on your credit history ranking.

Variables such as settlement history, credit report application, size of credit score history, kinds of credit history accounts, and brand-new credit score questions influence an individual's debt rating.Taking into consideration the influence of different economic choices on credit history scores, the use of solutions read this article like Afterpay can present special considerations in evaluating a person's credit report score. When customers miss payments on their Afterpay acquisitions, it can lead to negative marks on their credit documents, potentially lowering their credit history rating. Considering that Afterpay's installment plans are not constantly reported to credit report bureaus, accountable usage may not directly impact credit history ratings favorably. While Afterpay itself might not straight impact credit report scores, just how people manage their Afterpay accounts and associated payments can affect their total credit report score.